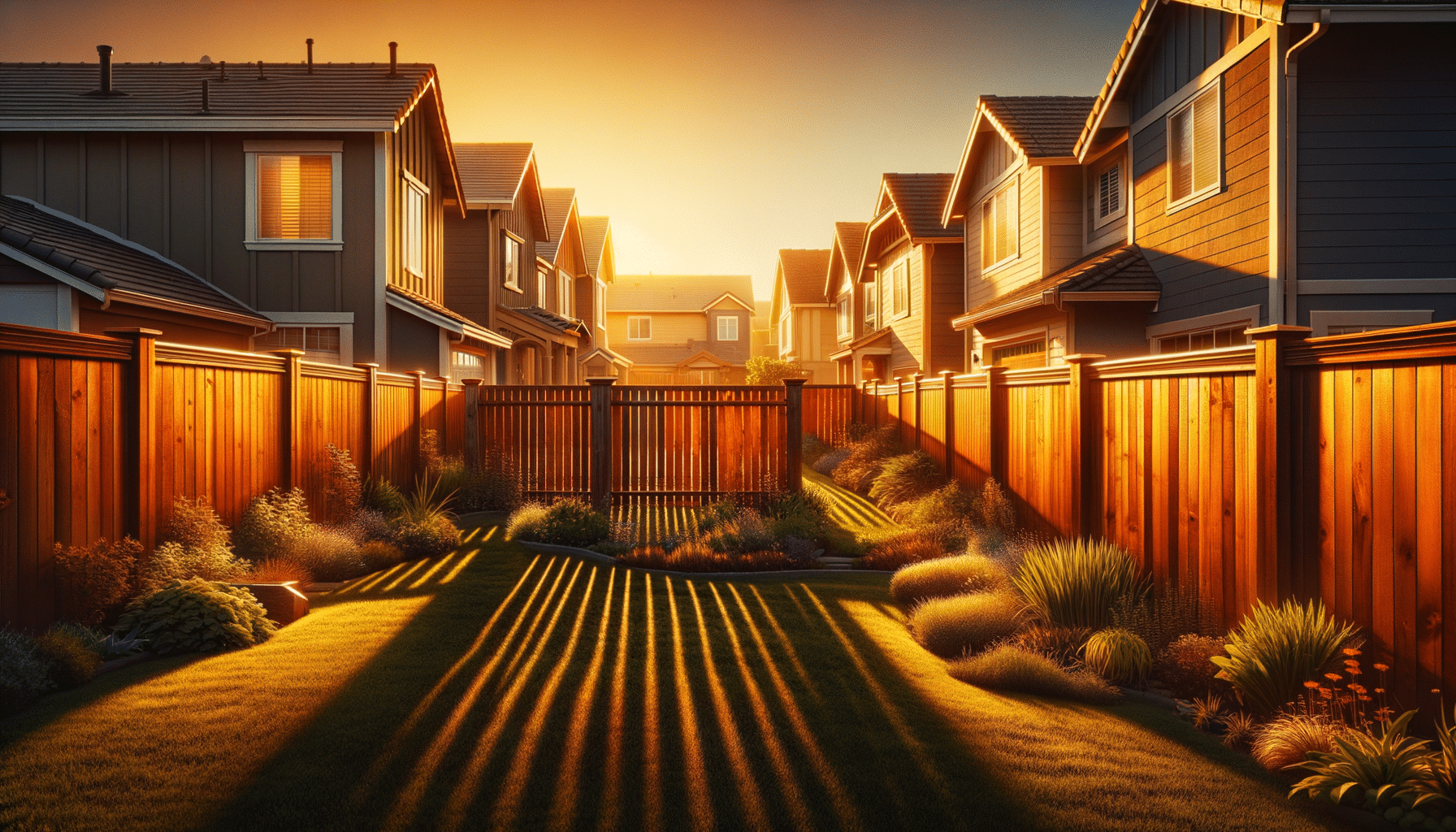

Fence Installation Financing Options: A Comprehensive Guide

Introduction to Fence Installation Financing

In the realm of home improvement, fence installation stands out as a significant investment that can dramatically enhance both the aesthetic appeal and security of a property. However, the costs associated with this upgrade can be substantial, leaving homeowners searching for viable financing options. Understanding the various financing avenues available for fence installation is crucial, as it enables homeowners to make informed decisions that align with their financial situations and project goals. This article delves into the diverse financing options for fence installations, offering insights into how each can benefit different financial circumstances.

Personal Loans for Fence Installation

Personal loans are a popular choice for financing fence installations due to their flexibility and accessibility. Offered by banks, credit unions, and online lenders, these loans can provide the necessary funds without the need to dip into savings. The application process typically involves a credit check, and the interest rates can vary based on creditworthiness. One of the main advantages of personal loans is the fixed interest rate, which means predictable monthly payments over a set term. This option is particularly appealing to those who prefer a structured repayment plan and have a solid credit score. However, it’s important to compare rates and terms from multiple lenders to ensure the most favorable conditions.

Home Equity Loans and Lines of Credit

For homeowners with significant equity, home equity loans and lines of credit (HELOCs) present another viable financing option. A home equity loan offers a lump sum with a fixed interest rate, while a HELOC provides a revolving credit line with variable rates. These options leverage the value of the home, often resulting in lower interest rates compared to personal loans. However, they do require the home as collateral, which introduces the risk of foreclosure if payments are not met. These products are best suited for homeowners confident in their ability to repay and looking for lower interest costs.

Credit Cards as a Financing Tool

Credit cards can also serve as a financing tool for fence installations, particularly for those with a high credit limit and promotional interest rates. Some credit cards offer 0% APR for an introductory period, allowing homeowners to spread out the cost without incurring interest. However, this option requires careful financial discipline, as failing to pay off the balance before the promotional period ends can result in high interest charges. Credit cards are most effective for smaller projects or when combined with other financing methods to manage costs effectively.

Contractor Financing Programs

Many fence installation companies offer in-house financing or partner with financial institutions to provide tailored financing programs. These options often include flexible terms and competitive rates, designed to fit the specific needs of the project. Contractor financing programs can simplify the process, as they combine the financing and installation into a single package. However, it’s essential to review the terms carefully and compare them with external options to ensure you’re receiving the best deal. These programs are particularly beneficial for those seeking convenience and a streamlined experience.

Conclusion: Choosing the Right Financing Option

Choosing the right financing option for fence installation requires a careful assessment of one’s financial situation, project scope, and long-term goals. Whether opting for personal loans, home equity products, credit cards, or contractor financing, each option has unique benefits and considerations. By understanding these options, homeowners can make informed decisions that enhance their property’s value and functionality without compromising financial stability. As you embark on your fence installation journey, consider consulting with financial advisors or lenders to explore the most suitable financing solutions for your needs.